San Diego Home Insurance for Dummies

San Diego Home Insurance for Dummies

Blog Article

Secure Your Satisfaction With Reliable Home Insurance Plan

Why Home Insurance Policy Is Essential

The importance of home insurance policy lies in its ability to supply economic defense and assurance to homeowners in the face of unanticipated events. Home insurance coverage functions as a security web, supplying insurance coverage for problems to the physical framework of your house, individual belongings, and responsibility for crashes that might take place on the residential property. In the occasion of all-natural catastrophes such as floodings, earthquakes, or fires, having an extensive home insurance coverage can help homeowners reconstruct and recuperate without dealing with significant financial worries.

Moreover, home insurance policy is usually called for by home loan lenders to safeguard their investment in the property. Lenders desire to make certain that their monetary interests are guarded in situation of any damage to the home. By having a home insurance plan in position, house owners can satisfy this need and protect their investment in the property.

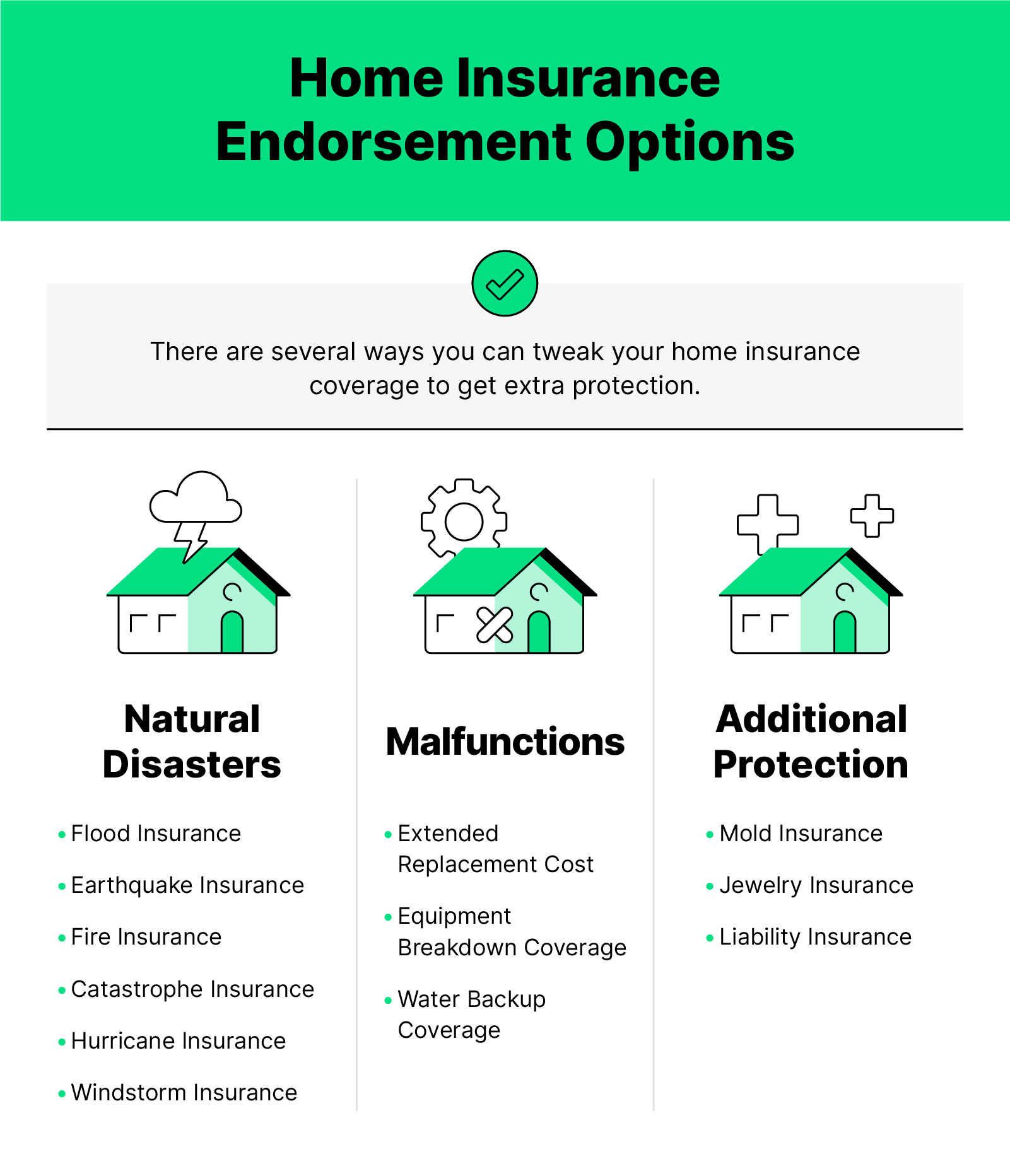

Kinds Of Insurance Coverage Available

Given the relevance of home insurance coverage in protecting house owners from unexpected monetary losses, it is critical to comprehend the various types of insurance coverage available to tailor a plan that suits private demands and circumstances. There are a number of key types of insurance coverage offered by a lot of home insurance policy policies. Personal property protection, on the various other hand, safeguards items within the home, including furniture, electronic devices, and clothing.

Factors That Effect Premiums

Elements affecting home insurance policy premiums can vary based on an array of factors to consider certain to specific circumstances. Older homes or residential or commercial properties with obsolete electric, plumbing, or heating systems may posture higher dangers for insurance policy firms, leading to greater costs.

In addition, the protection limitations and deductibles chosen by the insurance holder can influence the costs quantity. Opting for higher coverage limits or reduced deductibles usually results in higher costs. The kind of building materials utilized in the home, such as timber versus block, can additionally affect premiums as particular products might be extra vulnerable to damages.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Exactly How to Choose the Right Plan

Selecting the ideal home insurance policy includes mindful factor to consider of different vital aspects to guarantee detailed protection tailored to private requirements and situations. To start, assess the worth of your home and its components properly. Next off, think about the different types of protection readily available, such as dwelling coverage, personal property coverage, liability defense, and extra living expenses insurance coverage.

In website here addition, reviewing the insurance coverage business's reputation, economic security, customer solution, and declares process is critical. By carefully examining these elements, you can pick a home insurance coverage policy that gives the required protection and tranquility of mind.

Benefits of Reliable Home Insurance

Reputable home insurance coverage uses a complacency and security for homeowners versus unexpected occasions and financial losses. One of the crucial benefits of trusted home insurance policy is the assurance that your residential or commercial property will certainly be covered in the event of damages or devastation triggered by all-natural calamities such as fires, tornados, or floods. This insurance coverage can help home owners avoid bearing the complete price of repair work or restoring, providing assurance and monetary This Site security throughout challenging times.

In addition, reliable home insurance coverage often include obligation defense, which can safeguard property owners from legal and medical expenditures in the case of accidents on their building. This coverage extends beyond the physical structure of the home to safeguard against claims and insurance claims that may arise from injuries sustained by site visitors.

In addition, having trusted home insurance can also contribute to a sense of total well-being, knowing that your most significant financial investment is safeguarded versus numerous threats. By paying normal costs, house owners can alleviate the prospective financial burden of unexpected occasions, enabling them to concentrate on enjoying their homes without constant stress over what could occur.

Conclusion

To conclude, safeguarding a trusted home insurance plan is essential for shielding your building and personal belongings from unforeseen occasions. By comprehending the sorts of insurance coverage readily available, aspects that influence costs, and how to choose the ideal policy, you can guarantee your satisfaction. Counting on a dependable home insurance copyright will certainly provide you the you could try here advantages of financial security and protection for your most useful possession.

Navigating the world of home insurance can be complex, with different coverage choices, plan elements, and factors to consider to weigh. Comprehending why home insurance is necessary, the types of protection readily available, and how to select the appropriate policy can be essential in guaranteeing your most significant investment stays protected.Offered the importance of home insurance coverage in securing homeowners from unexpected monetary losses, it is vital to recognize the various types of protection offered to customize a plan that suits specific requirements and circumstances. San Diego Home Insurance. There are numerous vital types of protection supplied by the majority of home insurance plans.Selecting the appropriate home insurance policy involves careful consideration of various key aspects to ensure comprehensive coverage customized to individual requirements and scenarios

Report this page