San Diego Home Insurance Can Be Fun For Anyone

San Diego Home Insurance Can Be Fun For Anyone

Blog Article

Get the Right Defense for Your Home With Tailored Home Insurance Coverage Insurance Coverage

Customized home insurance policy protection uses a security internet that can supply tranquility of mind and economic protection in times of situation. Browsing the intricacies of insurance policy plans can be challenging, especially when trying to identify the exact insurance coverage your unique home requires.

Relevance of Tailored Home Insurance Policy

Crafting a tailored home insurance coverage is necessary to make certain that your insurance coverage accurately mirrors your private demands and conditions. A tailored home insurance plan goes beyond a one-size-fits-all approach, supplying you certain protection for your unique circumstance. By working closely with your insurance coverage service provider to customize your plan, you can guarantee that you are adequately covered in the occasion of a claim.

Among the key benefits of tailored home insurance policy is that it allows you to include protection for things that are of certain value to you. Whether you have expensive jewelry, rare artwork, or specific tools, a tailored policy can make sure that these possessions are secured. In addition, by tailoring your protection, you can readjust your limitations and deductibles to line up with your danger tolerance and monetary capabilities.

Additionally, a personalized home insurance coverage thinks about aspects such as the place of your building, its age, and any special attributes it might have. This tailored strategy helps to minimize prospective voids in insurance coverage that might leave you subjected to risks. Eventually, spending the time to tailor your home insurance coverage can supply you with comfort knowing that you have extensive protection that meets your details demands.

Analyzing Your Home Insurance Needs

When considering your home insurance needs, it is crucial to examine your individual circumstances and the details risks related to your property. Beginning by evaluating the worth of your home and its materials. Think about the location of your property-- is it vulnerable to all-natural catastrophes like earthquakes, typhoons, or floods? Review the criminal offense rate in your community and the chance of burglary or criminal damage. Examine the age and condition of your home, as older homes might need even more maintenance and can be at a higher danger for concerns like pipes leaks or electrical fires.

By extensively assessing these factors, you can determine the level of insurance coverage you need to sufficiently secure your home and assets. Bear in mind, home insurance coverage is not one-size-fits-all, so customize your plan to meet your specific demands.

Customizing Protection for Your Home

To tailor your home insurance policy successfully, it is important to customize the protection for your details home and private demands. When customizing coverage for your residential or commercial property, consider aspects such as the age and construction of your home, the value of your valuables, and any type of distinct features that might need special coverage. For instance, if you possess pricey precious jewelry or artwork, you might require to include extra protection to shield these things effectively.

In addition, the area of your building plays a crucial duty in personalizing your coverage (San Diego Home Insurance). Houses in areas vulnerable to natural disasters like floods or quakes might need extra protection not consisted of in a standard policy. Comprehending the dangers linked with your place can help you customize your coverage to reduce potential damages effectively

Furthermore, consider your lifestyle and individual preferences Click This Link when personalizing your insurance coverage. You may want to include protection for theft or criminal damage if you often travel and leave your home vacant. By tailoring your home insurance plan to suit your certain needs, you can make sure that you description have the appropriate protection in area for your building.

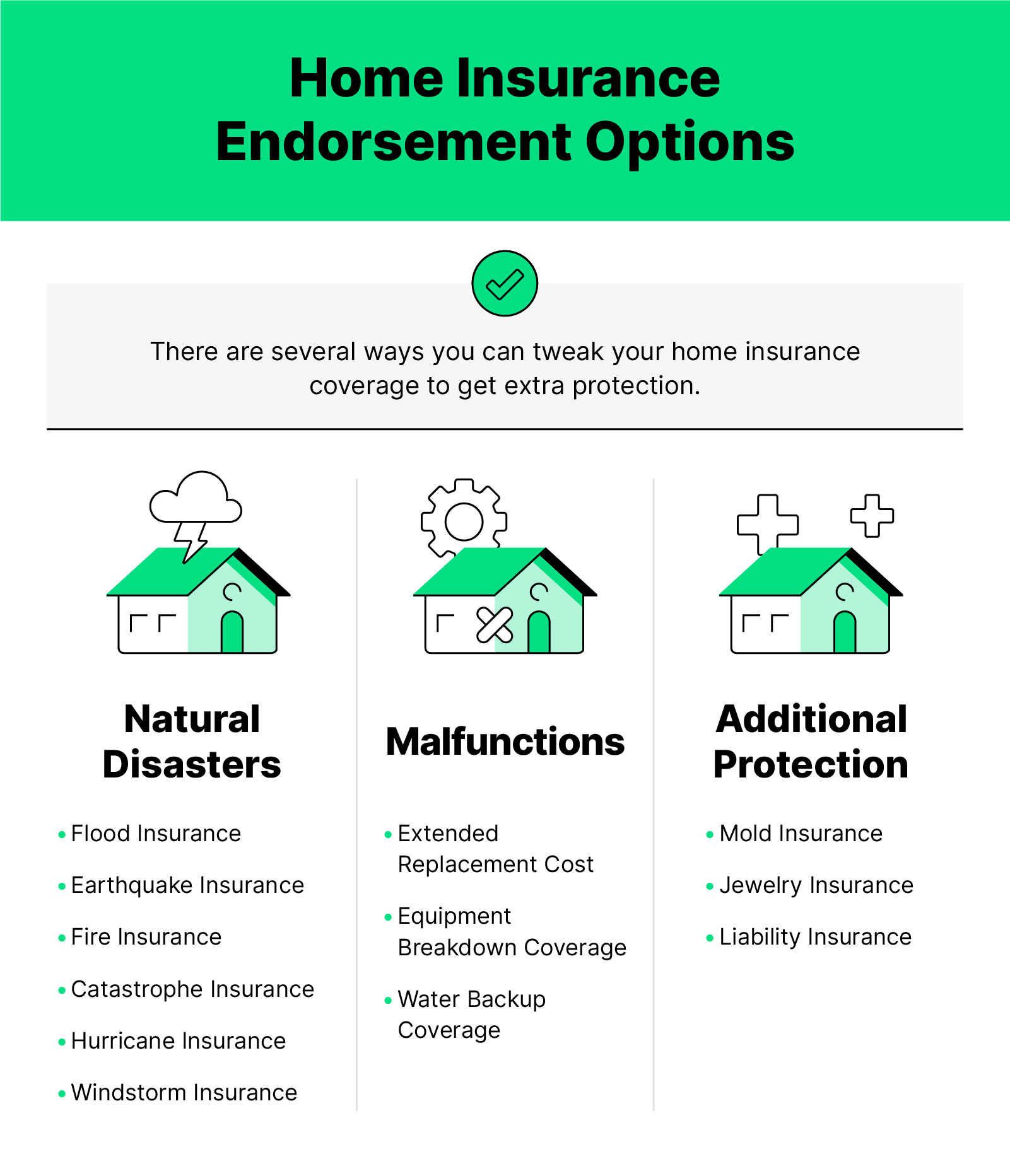

Comprehending Policy Options and Limits

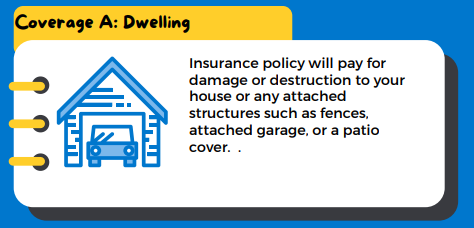

Checking out the different plan choices and restrictions is essential for acquiring a detailed understanding of your home insurance policy protection. Plan choices can include protection for the structure of your home, personal belongings, liability protection, added living expenditures, and extra. By very closely checking out plan alternatives and restrictions, you can customize your home insurance coverage to provide the defense you require.

Tips for Selecting the Right Insurance Company

Recognizing the significance of selecting the appropriate insurance firm is extremely important when guaranteeing your home insurance coverage straightens completely with your demands and offers the essential protection for your possessions. When picking an insurance company for your home insurance coverage, take into consideration aspects such as the firm's online reputation, monetary stability, customer care high quality, and coverage choices. Study the insurance provider's background of handling cases quickly and rather, as this is crucial in times of need. Inspect for any kind of complaints or evaluations online to evaluate customer complete satisfaction degrees. It's also recommended to compare quotes from several insurance firms to guarantee you are getting competitive prices for the coverage you need. Another tip is to assess the insurance provider's desire to personalize a policy to fit your particular demands. A great insurance provider ought to be transparent concerning what is covered in the policy, any type of exemptions, and the procedure for filing an insurance claim. By complying with these ideas, you can make a notified decision and choose the right insurance provider for your home insurance needs.

Verdict

:max_bytes(150000):strip_icc()/dotdash-home-warranty-vs-home-insurance-5081270-Final-b2fa2539ff3c475296bae8529873651f.jpg)

Crafting a personalized home insurance coverage policy is crucial to make certain that your protection accurately mirrors your private needs and conditions (San Diego Home Insurance). Examine the age and condition of your home, as older homes might call for more upkeep and might be at a greater threat for problems like pipes leakages or electric fires

To customize your home insurance coverage plan properly, it is vital to customize the insurance coverage for your particular building and private demands. When personalizing insurance coverage for your residential property, think about variables such as the age and building of your home, the value of your items, and use this link any type of unique attributes that may call for special coverage. By carefully examining plan choices and restrictions, you can tailor your home insurance policy protection to supply the security you require.

Report this page